In a bold move to protect the integrity of the Rwandan Franc, the National Bank of Rwanda (BNR) has issued a firm warning against the illegal use of foreign currencies in domestic transactions. This comes following the enforcement of Regulation No. 42/2022 of April 13, 2022, governing foreign exchange operations.

The new directive, effective from May 30, 2025, targets the widespread pricing and payments made in foreign currency, especially in border towns, hospitality sectors, casinos, duty-free shops, and cross-border trade.

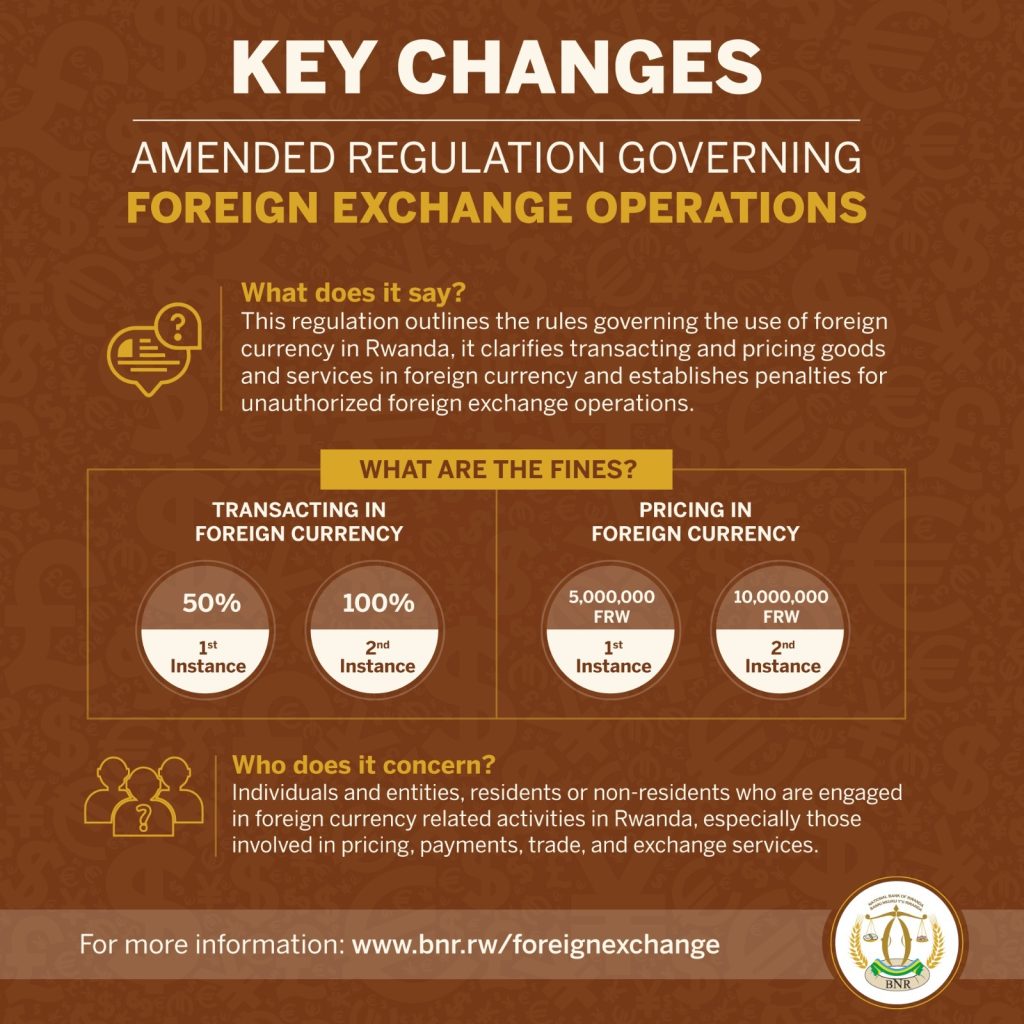

According to BNR, individuals or businesses found pricing goods or services in foreign currencies such as the U.S. dollar without proper authorization will face hefty penalties. First-time offenders will be fined RWF 5 million, while repeat violations will attract RWF 10 million. Those transacting in foreign currency without approval will incur fines equivalent to 50% of the transaction amount on the first offense, and 100% for repeated violations.

The regulation also sets penalties for auctioneers who conduct sales in foreign currency, with fines up to 50% of the auction value. This measure is aimed at discouraging the normalization of foreign currency use in domestic markets, which undermines monetary policy and weakens the local currency.

BNR is urging all individuals and businesses to comply and use only the Rwandan Franc in domestic economic activities. The bank stresses that its mission to stabilize the economy and fight illegal financial practices remains a top priority. It has called on the public to report any suspected violations through official channels, including the Rwanda Investigation Bureau (RIB) and the Rwanda National Police.

This renewed crackdown demonstrates the central bank’s unwavering commitment to preserving monetary sovereignty, strengthening financial discipline, and promoting trust in Rwanda’s national currency.